LONG: Dun & Bradstreet (DNB)

Recommendation: Dun & Bradstreet (Ticker: DNB)

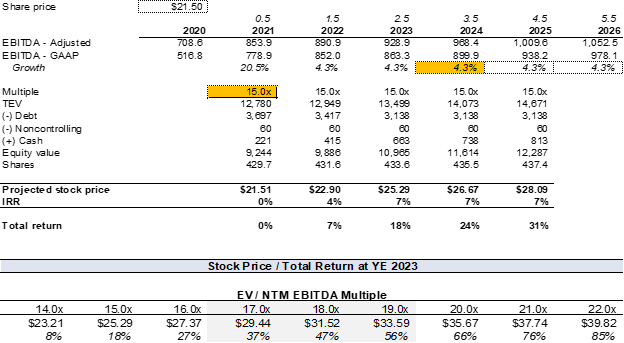

Market cap: $9.3bn; Stock Price: $21.50

Upside: >+25% per annum 1-3 years

Downside: +5-7% per annum 1-3 years

Thesis: The business / information services subsector is one of the most prized blocks in both the financial services sector and across all sectors more broadly. These companies generally possess the most desirable business characteristics like wide moats, sustainable business advantages, exposure to structural growth, high incremental margins, and attractive economics for shareholders largely due to the mission-critical and non-deferrable nature of the services they provide. Over the last 3 years valuations across this subsector have expanded >20-30% as a result of A) valuation expansion that has occurred across the entire market and B) increasing investor appreciation for these companies.

One company in this subsector with all of these qualities, however, has notably been left behind in this market – Dun & Bradstreet (D&B). D&B is an 85% recurring revenue, >96% revenue retention, high switching cost business that has fundamentally underperformed for over a decade by failing to both grow revenues >1% and deliver margin expansion that peers have executed. But, the company is now on the cusp of an operational inflection point after its recent take-private and restructuring by Bill Foley and team. The multi-year business turnaround, now in year three, will begin to bear fruit as the company reports the first quarter of “clean” organic growth >3% in 2Q21 with gradually accelerating organic growth in 2H21 and 2022 to 3-6% due to a number of exciting factors. The major positive emerging dynamics include 1) pricing power extraction due to a growing mix-shift into multi-year contracts with price escalators (48% of revenue on multi-year contracts as of 1Q21); 2) deeper customer penetration across large enterprise and mid-market customers via cross-sell / upsell and new solutions (5% of clients use both solution sets), and 3) “net new logos” from streamlining the SMB offering / go-to-market strategy, which was historically ignored, and attacking the international opportunity. The acquisition of Bisnode will also support organic revenue growth from a number of different avenues domestic and international. Ultimately, the organic growth floor is set at +3% with +1.5% driven by each pricing and cross-sell / upsell with the upside from the “floor” likely driven by net new customer growth, new solutions and organic growth accretion from acquisitions, with Bisnode driving 2022 upside. In addition, 2Q21-2H21 reported organic revenue growth will also optically benefit from the lapping 1) of new revenue-recognition accounting standards implemented in 1Q20 and 2) modest COVID-related revenue headwinds with hopefully greater client utilization of products in 2H21 in an economic recovery (banks, insurance companies, etc. credit pulls from loan growth; broader corporate client sales and marketing data pulls). It’s the expectation that 2Q21 should be a catalyst for investor appreciation.

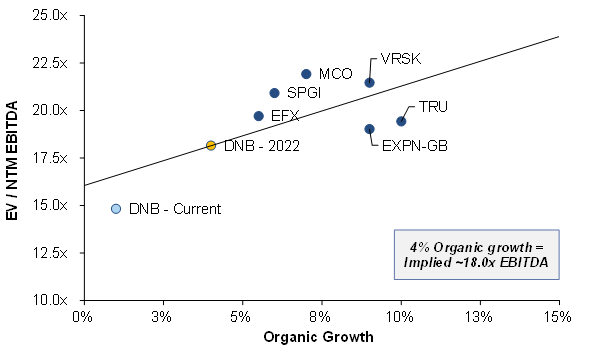

D&B originally came to across our desk from screening the worst-performing companies over the last year with the highest amount of insider buying and to our surprise the company sits as the 19th-worst-performing stock of all US public companies with insider mgmt buying since the IPO (companies with market cap >$2.0bn). The company IPO’d at $25.00/share and now a year later at $21.50 and the large underperformance in a bull-market many large investors, based on our conversations with them, have become frustrated with this underperformance of the stock and have either trimmed or sold out completely of their positions, which may have also added to some of the underperformance (a large investor completely sold and was a top 5 largest shareholder). This is our oppy and it’s important to note that this was in spite of mgmt executing or exceeding on virtually every metric / guidance that has been communicated to the investment community. Additionally, the valuation at IPO was 21.0x EV / NTM EBITDA, a valuation in-line with peers, and currently trades at a valuation of 15.0x EV / NTM EBITDA as projections for EBITDA and earnings have grown and not just been met but actually exceeded and the stock has lagged. Peers that possess MSD organic growth trade >20.0x EV / NTM EBITDA.

At this point, the risk/reward appears attractively asymmetric with the downside return IRR of 5-7% (+18% total return) over the next 3 years and the upside return IRR of >25% (+65% total return) over the next three years (downside = return generated from annual EBITDA growth of +5-7% and no multiple expansion; upside = return generated from annual EBITDA growth of >+8% and an exit multiple of 20.0x, which is below the IPO multiple of 21.0x). When evaluating probabilistic outcomes a downside revenue growth scenario below 0% with the positive momentum that the company has already generated on a core basis appears to be fairly low (e.g. 2020 revenues were flat). And if mgmt delivers on just consistently generating 3-4% organic growth, and the core organic growth figure was >3% in 1Q21 ex-various one-time items, it stands to reason the business should continue to grow revenues, margins and earnings and the multiple should expand to at least 18.0x in light of a regression-implied multiple based on organic growth and EV / NTM EBITDA and a DCF-implied exit multiple analysis and deliver a 45% return over 3 years.

A comprehensive business turnaround by Bill Foley & Co. In February 2019, an investor consortium (“Consortium”) led by Bill Foley, Thomas H Lee, Cannae Holdings, Black Knight and CC Capital identified Dun & Bradstreet acquired the company in a take-private transaction “after identifying the company as an undervalued asset with potential.” The Consortium immediately commenced the Bill Foley playbook for business transformation. This was headlined by the reorg of the mgmt team with the appointment of Anthony Jabbour as CEO, Steve Daffron as President, and Brian Hipsher as CFO. In addition, 18 of the 19 executives (95%) and 30 of the 46 (65%) members of the broader leadership team are now new or in a new role.

- Expense realignment: The new team’s first order of business was the structural reorganization of the expense base to improve the sales team, data quality, tech-stack, and position the company for growth. Below are the steps taken to rationalize the expense base:

o Reorganize mgmt and operating infrastructure into vertically aligned business units

o FTE turnover of ~1.5k and net FTE reduction of ~850, or 17% of total FTEs

o Run-rate expense savings of ~$250mm with EBITDA margin expansion >500 bps

- Simplified tech-stack and improved data quality and data analytics: The biggest knock on D&B while the company was previously public was that while the data was unmatched in quality and depth, especially in the less commoditized SMB space, there were numerous data delivery inaccuracies and the delivery was in too unstructured. Below are the steps taken to improve the “Data Cloud” and enhance the delivery of data to clients:

o Re-architecture of tech platform to enhance ability to organize and process high volumes of disparate data and improve delivery

o Implemented a "Data Watch Program" to proactively monitor and repair issues before clients experience them (channel checks indicate that this was a key focus of new President Steve Daffron who was previously a D&B customer)

o Systematically track and monitor service metrics and key service performance indicators to more effectively assist our clients

o Increased coverage of small- and medium-sized businesses ("SMBs") and incorporating new, alternative data sets to expand the breadth and depth of information

o Growth in data scientists on staff to 84 data scientists as of 4Q20

It should be noted that Anthony is a dual-CEO with head roles at both Black Knight and D&B. Historically, by statistical standards dual-CEO shareholder creation performance, although anecdotally concerning for investors given the potential for the top-dog to not be as focused on one business, have not been poor but the sample size is undeniably small. It should also be noted that it is more often by co-founder CEOs and founder-led businesses have also outperformed traditional benchmarks – Anthony is not a co-founder of D&B.

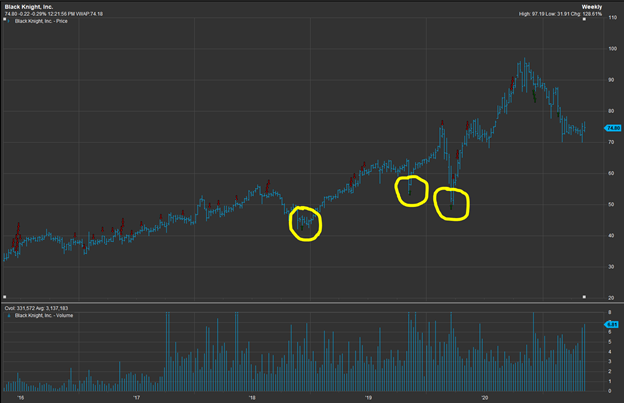

A completely new mgmt team that is aligned and incentivized. The new senior executive team including Anthony Jabbour (CEO), Steve Daffron (President), Bryan Hipsher (CFO) is highly incentivized. Anthony owns >$100mm in public stock, Steve owns >$85mm of public stock and Bryan owns >$15mm in stock. Bill Foley also owns >$275mm in public stock. In connection with the IPO the board also granted stock options to Jabbour, Daffron and Hipsher based on an exercise equal to $22.00/share that vest ratably over the first three years of the date of grant. The amount of the grants are not disclosed, unfortunately, and it should be noted that this isn’t unheard of. Mgmt in addition is putting their money where their mouth is and buying more stock with Anthony and Bryan each acquiring more shares in February, ‘21 at $23.20/share and in November, ’20 at $26.00/share. (Note: A historical look-back of Anthony’s insider acquisitions of stock in Black Knight (BKI) were / are attractive opportunities for equity investors that historically have led to stock outperformance vs the S&P 500, R1G and RMG. See Fig. 1 below.) And, thirdly there is a fairly large incentive for both the board and mgmt for a sale of the company. Mgmt has a very large change of control (CIC) package that is beyond much of what is seen at a typical public company of this size (that isn’t a tech company).

Fig. 1) Historical Insider Acquisitions of Stock by CEO Anthony Jabbour of Black Knight (BKI)

Source: Factset

While not a high probability given the strategic landscape, a sale of the business would make the mgmt team a lot of money. In the event of a chance in control (CIC), the primary four senior executives are due to receive a cash payment of >$2.0mm, which isn’t that uncommon. Jabbour, Daffron and Hipsher, however, each also stand to make >$65.0mm, >$50.0mm and >$8.0mm in immediate stock vesting should the company sell, which is uncommon. Jabbour’s agreement “also provides that, in the event we are sold during the employment term and/or outperform our financial projections in any calendar year, Mr. Jabbour is eligible to receive a discretionary bonus in an amount determined by the compensation committee.” Under Jabbour’s CIC package at Black Knight, where he is also CEO, he is only due to receive >$4.5mm in cash (assuming termination) and >$13.0mm in immediate stock vesting. There is a fairly large difference between these two plans. There are also a sizable amount of insiders from the take private including Thomas H Lee, Cannae and Black Knight that are expected to look for a monetization event over the coming few years either in the form of a higher stock price or sale. (Note: all insiders have not sold shares yet despite lock-ups expiring in December, ’20.) In reality, the higher probability considerations are that while the economics and immediate liquidity are obviously attractive for both the mgmt team and investor base in a potential sale at an attractive price the list of potential strategic acquirors does not appear to be large (SPGI, MCO, ICE, EFX, TRU) and there me be a textbook “private equity” overhang / potential technical over-selling in the market when there is some good momentum in the business and stock so this is something to be aware of.

A moaty business model that survived over a decade of mismanagement. D&B survived over a decade of poor business mgmt due to undeniably wide moats and strong competitive advantages. To begin, D&B operates in two distinct business segments and business end-markets globally that possess varying degrees of moats and competitive advantages. These segments are Finance & Risk (F&R) and Sales & Marketing (S&M):

- Finance & Risk (F&R): In the F&R segment the company provides mission critical solutions to manage risk, minimize fraud and monitor their supply chain. Top commercial enterprises in the world utilize solutions to make better decisions when considering small business loans, extending trade credit, analyzing supplier relationships and collecting outstanding receivables. The key customers of these services are primarily the finance, treasury, and risk departments (i.e. Chief Financial Officers and Chief Compliance Officers) of various enterprises across nearly all verticals. In addition, D&B is also known for its PAYDEX score, a performance-based metric that evaluates the overall financial health of a business based on historical payments and is used by creditors to determine whether a loan should be approved and at what interest rate, and potential business partners as to whether one should enter into a relationship with a given enterprise. The PAYDEX score can be considered a commercial FICO score for businesses. In a more detailed breakdown about 92% of revenues in F&R are Finance Solutions, which are live global credit data, credit history monitoring, enterprise risk mgmt, and automated cash collections, and the balance (8%) are Risk and Compliance Solutions, which are generally supply chain risk, KYC / AML and customer/supplier onboarding. The Risk and Compliance Solutions are generally viewed as high growth

o Market growth rate: -2% - +2%

o Market share; trend: >70%, modest share loss

o D&B historical growth rate: -1.0+1.0%

o Competitors

§ Enterprise and mid-market include Equifax and Experian in North America

§ SMB market includes Equifax, Experian as commercial credit health becomes increasingly tied to consumer credit health

§ International

· In Enterprise and mid-market it’s Bureau van Dijk (owned by Moody’s Corporation) in Europe

· United Kingdom and Ireland: Bureau van Dijk, Creditsafe and Experian.

· Asia Pacific: Sinotrust International Information & Consulting (Beijing) Co., Ltd., in China and local competitors in India

- Sales & Marketing (S&M): In the S&M segment the company provides solutions to help businesses find new revenue oppy’s and accelerate growth by leveraging the Data Cloud to obtain traditional and non-traditional data and analytics on commercials. The key utilizers and decision-makers here are Chief Marketing Officers, Chief Operating Officers, and sales divisions. In a more detailed breakdown about 56% of S&M revenues are Data Mgmt, which are customer profile firmographics that feed into a clients CRM, 38% are Sales Acceleration, which is a more value-add solution that enables firms to generate AI-powered customer targeting / campaigning / customer pipelines, and the remaining 7% are Digital Marketing solutions, which as the name suggests help companies digitally market themselves and are also viewed as higher value-add than the Data Mgmt solutions.

o Market growth rate: +2-4%

o Market share; trend: Share loss

o D&B historical growth rate: 0.0+2.0%

o Competitors

§ Similar to F&R, enterprise and mid-market include Equifax and Experian in North America and Bureau van Dijk (owned by Moody’s Corporation) in Europe

§ ZoomInfo for contact data and a few consultancies building bespoke solutions

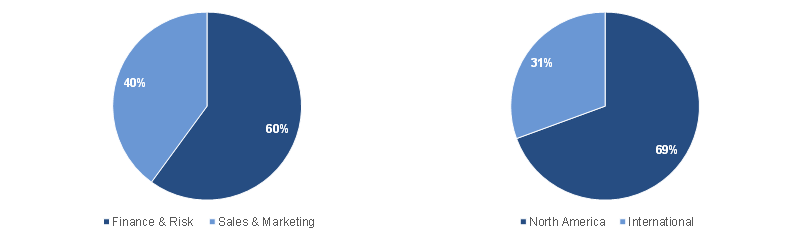

Fig. 2) D&B Revenue Mix by Segment and Geographic (FY 2021)

Source: Company data

Here are the moats:

- Scale: The foundation of business is built on the “scale, depth, diversity and accuracy” of the platform’s Data Cloud, which has sustained itself despite years of underinvestment. The Data Cloud, to which the new mgmt team is increasing capital allocation, contains comprehensive information on >475mm public and private businesses in >240 countries globally that includes traditional information such as commercial contact, ownership / organization structure, financial statements, credit profiling and non-traditional information such as foot traffic, website usage, social media posts, online browsing activity and shipping trackers. This vast array of data are compiled from >16k sources and 15 global partners within their Worldwide Network alliances (WWN alliances) cover nearly all industry verticals with a wide range of use cases.

- Industry standard brand fly-wheel: While the brand moat is typically the weakest, D&B possesses a well-respected and recognized brand in the industry that fuels a fly-wheel like dual-party incentive structure to rely on D&B. Commercials are incentivized to submit and self-report relevant business profile information relying on D&B to permit their business to participate in bidding on contracts and/or receiving grants from the gov’t, initiating and/or accelerating the process of receiving credit from lenders, supplying a major company like Wal-Mart and Target, and launching an iOS App. And then In turn, gov’ts, banks, lenders, commercials and iOS rely on Dun & Bradstreet for this commercial business information that is generally known as the industry standard that they themselves have established. The risk here is obviously demand-side, whereby if clients decide to untangle D&B’s Data Cloud from their internal processes and controls, but it should be noted that no client accounts for >5% of revenue. However, if >1-2 large client losses manifest there would be cause for concern. Critically, the company assigns each corporate entity globally a D-U-N-S Number, which serves as an identifier akin to a "fingerprint" or "Social Security Number" to link this data to corporations. Over time the D-U-N-S Number has become recommended and, in many cases required, by >250 government, trade and commercial organizations globally. Below are some powerful examples:

o Governments: Many local, state and federal gov’t organizations require a D-U-N-S Number to bid on contracts and/or receive grants. Ex: Internal Revenue Service (IRS), System Award Management (SAM), Small Business Administration (SBA). Additionally,

§ In Japan, D-U-N-S Number is recognized as the only global identifier for business entities.

§ In the Middle East, the governments of Dubai and Abu Dhabi both require the D-U-N-S Number for business registration

§ And, more globally, the World Customs Organization (WCO), recognizes the D-U-N-S Number as the acceptable identifier in its WCO Customs Data Model and the International Trade Data System (ITDS) has recommended the D-U-N-S Number as an alternative identifier for all ACE transactions. Additionally, the FDA Data Standards Council requires the D-U-N-S Number as the business entity identifier and the United Nations also uses the D-U-N-S Number as their Consignee Party Identifier

o Banks, lenders: If a business is applying for loan or line of credit many bank and organizations (gov’t or non-gov’t) require a D-U-N-S Number. Ex: Bank of America, PNC

o Commercial business partners: If a business has a goal to become a supplier for a major company then a D-U-N-S Number is effectively mandatory. Ex: Amazon, Wal-Mart, Kroger, Target, Kohls, Intel, General Motors Supply Power, Aetna, Porsche, BMW, and DTE Energy

o Apple apps (iOS developers account): Apple requires a D-U-N-S Number in order to create a “Company” iOS developer account. The number will be used to check the identity and legal entity status of the business as part of their enrollment verification process for joining the Apple Developer Program or the Apple Developer Enterprise Program

- It should be noted here that the Government Services Agency (GSA) awarded a $41.75mm contract to Ernst & Young (E&Y) for up to 5 years for entity validation services for the federal award process through GSA’s System for Award Management (SAM) in 2019. This certainly makes for a bad headline, is a potential demand-side risk for the company, and does not happen often but they do it’s likely an outcome of a competitive RFP process. However, on the flip-side, the adoption was delayed 16 months and potentially more given the difficulty in the transition (i.e. switching cost which will be discussed next) and represents 0.5% of 2020 revenues on an annual basis.

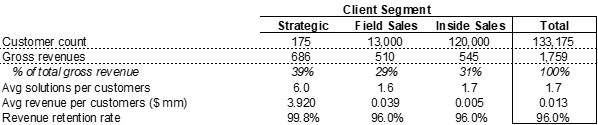

- High switching cost self-evident in numbers: Switching cost is the most powerful moat the business possesses. D&B’s data and analytics solutions are deeply embedded within their clients’ mission critical risk control, compliance, supply chain mgmt and other workflow platforms and particularly among D&B’s “Strategic Clients”. This is evident in the fact that A) 20 of the company’s top 25 clients have been clients for >20 years, B) Strategic Clients, which comprise ~90% of Fortune 500, ~80% of Fortune 1000 and ~60% of the Global 500, use ~9 of solutions on avg, and C) the company’s annual revenue retention rate is ~96% (with the client retention rate in the high 90’s). While, D&B has indicated that a large growth oppy for the platform is to address the SMB market, which will be discussed in more detail later, multiple channel checks have also indicated that this moat generally appears to be strengthening as client internal processes become more technologically-driven and reliant on APIs to link structured data into their business processes. There’s also the qualitative component of understanding and dealing with the D&B lexicon and data analytics outputs like PAYDEX and more that have been effectively institutionalized benchmarks. This ultimately is feeding into D&B’s previously untapped pricing power and ability to retain clients on multi-year contracts, which will also be discussed in more detail later.

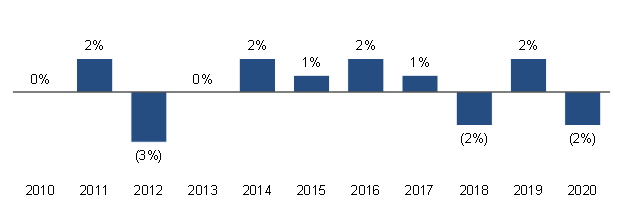

Fig. 3) D&B Historical Organic Revenue Growth

Source: Company data

Organic growth is finally accelerating to a sustainable 3+%. The company’s ability to generate organic growth sustainably >3% and ideally >4% will be the critical driver of an attractive return on an investment in Dun & Bradstreet. Importantly, see below for mgmt’s communicated organic growth targets from the IPO, which have not been amended.

- Near-term: +0-3%

- Intermediate-term: +3-6%

- Long-term: +4-7%

In hindsight the company likely went public too early post the take-private and subsequent restructuring due to a number of transitory impacts on reported organic growth figures in 2020 that shook the confidence of many investors. (Note: Reported organic growth of -2% in 2020.) From a fundamental perspective, the business experienced modest COVID-related lower utilization headwinds of -1-2% and the sun-setting of a handful of smaller business adjacency revenue streams that were concluded to be non-core with Data.com and an international revenue-sharing agreement the largest. Additionally, there were also a number of smaller items that impacted reported organic growth with the change in revenue recognition accounting standards the largest item. These headwinds all impacted the reported organic growth figures in 2020 and in 1Q21, which was a major driver of the investor frustration and subsequent poor stock reaction to both 4Q20 and 1Q21. One question from the 1Q21 earnings call was effectively “You reported a 1.3% headline organic growth figure but you say it’s really >3% so which is it?” It’s important to note though that the company still reported organic growth figures within the “near-term” guidance of 0-3% from 2H20-1Q21 and after 1Q21 mgmt reaffirmed organic growth guidance of +3.0-4.5% for 2021.

The business, however, is finally poised to report BOTH “clean” organic growth figures in 2Q21 and accelerating organic growth figures in the 2H21. To start, the company’s transitory headwinds to “clean” headline organic growth figures will lap in 2Q21 with all of the aforementioned items now in the rearview mirror. And even more importantly, as these obfuscating issues pass the reported organic growth figures in 2Q21 should be >3%, generally in-line with the core figure in 1Q21, which will put the company within the range of their intermediate-term guidance. This will be a major milestone for the company. The outlook is also positive as we look out into 2H21 and into 2022 with the expectation that the organic growth of the business should incrementally accelerate to >3.5%, hitting mgmt’s guidance for 2021, and sustain these figures in 2022. To get there, the company has taken a number of steps, which will hopefully ensure that the company’s organic growth sustains itself above >3% at the minimum after decades of +0-1%. Here is the strategy:

1) Simplify the tech-stack and improve data quality and data analytics. The first step, detailed previously, was to simplify the tech-stack and improve data quality and data analytics. Historically there were too often issues with A) the data and information interfaces / APIs, B) accuracy of data delivery, C) and the nature of how the data is delivered. Importantly, this was an area that the company lagged peers in. Based on a number of channel checks the company has materially improved all of these issues and is more competitive than or as competitive as all peers on these fronts. The company also feels like they’ve made good progress but are still investing in the improvement of these historically issues to earn the “moral high ground”.

2) Reorganized go-to-market strategy and salesforce

o Significant turnover of sales force

o Sales team now separates clients into and operates in three primary tiers, Enterprise, National and small- and medium-sized businesses ("SMBs")

§ Enterprise clients are each managed by a designated team, many of whom work on clients’ premises given the importance of strategic relationships

o Revamped sales commission plans to more appropriately incentivize sales of long-term contracts and the cross-selling of additional solutions rather than focusing on the annual renewal of existing contracts

§ 48% of business was sold in multi-year contracts as of 1Q21 (vs. 20% as of 2Q20). Multi-year contracts with pricing escalators are a key driver of the accelerating organic growth algorithm

§ Conducted pricing elasticity studies to evaluate potential to realign price to value

o Refocused sales process on individuals that have significant influence over the buying process at companies

o Require sales certifications from salesforce and instituted talent assessments and mid-year performance check-ins to ensure accountability

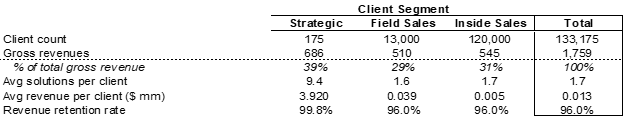

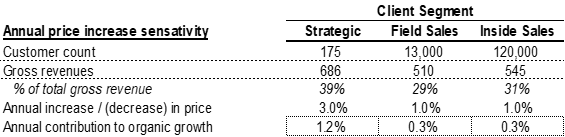

Fig. 4) D&B client base by sales verticals (FY 2020)

Source: Company data

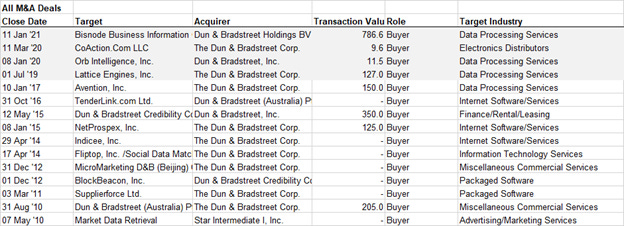

3) Realigned price-to-value for products and uncovered previously untapped pricing power: +1-2%. The foundation of organic growth generation builds from pricing power at most business / information services companies and this new mgmt team, through upgrades to the tech-stack to obtain the “moral high ground” and a number of customer elasticity studies, discovered that the business has a significant amount of untapped pricing power. Mgmt has indicated that pricing is currently contributing >1% to organic growth but that in 2H21 it is likely to reach “close to 2%” where it should remain into 2022.Pricing power is specific to customer segments however:

a. Strategic clients: There is significant pricing power in this segment given the deeply embedded nature of the products and services into work flows (avg >9 products per customer). Almost 2/3rd of customers were on multi-year contracts as of 1Q21 and it’s likely that this figure may comfortably reach >80%

b. Field sales: This customer segment has much potential over an intermediate and long-term if the sales team successfully cross-sells products and services. At the moment this is just untapped potential, however

c. Inside sales: There is limited pricing power at the moment but there is potential down the road if D&B Marketplace successfully increases customer product penetration

A pricing power sensitivity analysis suggests that pricing should comfortably sustain a >1% and is likely to sustain a >1.5% contribution to annual organic growth. So firstly, mgmt indicated multi-year contract agreements generally include a pricing escalator of close to +3% (sign an annual contract and it’s +4-5% or sign a multi-year contract and it’s close +3%). If one assumes that all strategic accounts benefit from a +2-3% price increase on an annual basis (+2.5%) then pricing across just this segment would result in a +1% contribution to organic growth (+0.4% x 2.5% = +1.0%). Then as for the Field Sales and Inside Sales it’s A) likely that there is pricing power at various Field Sales accounts and B) Inside Sales it wouldn’t be unheard of if there was a nominal price increase across the Inside Sales customer base. So as you can see below, assuming that a nominal increase of +1% across the Field Sales and Inside Sales customer bases that would result in +0.6% in additional organic growth bringing the total contribution to organic growth from price to >1.5%.

Fig. 5) D&B pricing power sensitivity

Source: Company data

4) Cross-sell / upsell existing products is the next lever to generate organic growth: +1-2%. The next lever to pull is cross-sell / upsell to the existing customer base (i.e. consistent with strategy to better monetize existing customer base). D&B has indicated that the company sales team intends to increase cross-sell / upsell in two fashions. The first is that with a customer base that is increasingly under a multi-year contract, especially Strategic clients and some Field Sales clients, the client conversations have evolved from renegotiating annual contracts to cross-sell / upsell and taking more wallet share. This is a multi-year process, however, the company is encouraged by what they have already experienced. And secondly, the company believes they are better suited to cater to the SMB market due to better data packages, data delivery interfaces and new holistic SMB enterprise-wide one-stop shop solutions, which will be discussed in more detail. Ultimately, time will tell whether the company will be able to increase customer penetration there are two remarkable statistics that illustrate the untapped potential revenue from incremental cross-sell / upsell: 1) avg product / solution per client <2 out of >16 major solutions and 2) 5% of customers use one of F&R and S&M solution sets (i.e. large TAM). The SAM is another conversation and an answer that is difficult to ascertain, however, here is one way to think about it. There are ways to mathematically solve for what needs to happen in order to drive revenue growth. For Strategic customers, adding 1 product across 15% or 26 customers of the customer segment would accrete +1% to overall organic growth. For Field Sales customers, adding 1 product across 5% or 650 customers of the customer segment would accrete +1% to overall organic growth. For Inside Sales customers, adding 1 product across 5% or 6,000 customers of the customer segment would accrete +1% to overall organic growth. See below for a sensitivity. Ultimately, forecasting how / when / if cross-sell / upsell will transpire is incredibly difficult for a number of reasons / questions. Channel checks with a handful of small businesses suggest that there is definitely room however to move to more holistic “servicing” of customers or making customers clients vs the more transactional data delivery model and the numbers suggest that there is much whitespace to deepen penetration across multiple customer segments.

Fig. 6) D&B cross-sell / upsell sensitivity

Source: Company data

5) Net new customers or “logos”: +0-1%. This growth lever is fairly straight-forward in concept but the achievement of consistent growth possesses greater execution risk compared to instituting price increases and cross-sell / upsell. The first order of operations, to achieve sustainable net new customers, is to continue to increase retention rates and then the second order is to attack the market. Retention rates, as you can see below are 99.8% in the Strategic customer segment which effectively eliminates this client segment from increases. The opportunity therefore clearly lies within the Field Sales and Inside Sales customer segments. There isn’t much to add here than it in theory makes sense to assume that the Field Sales segment may perhaps have the best opportunity to increase products per customer and therefore switching cost and therefore retention rates given their larger scale / size and potential to require more products vs a smaller organization. The company has however indicated that they are specifically excited about increasing products per customer at the SMB segment, which was detailed above and below. On retention rates more broadly it’s safe to assume that retention rate increases will be very, very minimal if it all given that there are modest transactional revenue streams and customers within the Inside Sales segment at the low end are much more a la carte acquirors of data / information. Moving to attacking the market, the company is excited about two opportunities:1)SMB space, which has historically been largely ignored by prior mgmt teams and 2) the international space. The SMB opportunity is enticing b/c there is a very large TAM with a low current penetration rate. There are >30mm small businesses in the US (but you can prob eliminate at least 50% of those business from the SAM due to size) and D&B possesses 120k customers. Within this opportunity is a lay-up fornet new customer growth and that’s increasing website conversion rates. Today, >1.5k potential customers visit the SMB website per day on a self-directed basis (+20% YoY), however conversion rates were low historically b/c there were 5-6 different web pages that potential customers would reach. Now there is only one, simplified landing page, which is an incredibly easy fix to support conversion rates and the company is seeing progress there. There are also now a handful of new holistic business interfaces and products that are more geared to this segment like D&B Connect, D&B Marketplace, and D&B Rev.Up. This is to support cross-sell and greater life-time value. (This whole solution set and interface is new: https://www.dnb.com/solutions/small-business.html). While competitors in this space like Zoominfo in particular have experienced massive growth / success, conversations with those industry on both the customer side and competitor side both anecdotally believe there is an opportunity for D&B. One channel check was with the cofounder of Lattice, which is a company that sold to D&B in 2019, and believes that the company has a lot of potential to compete in this market – a different view from most in the industry.The international opportunity is the second major one that exists for the company. Superficially there is lower market share across the Global 500, however, the sales cycle is long to acquire customers from entrenched, multi-year agreements with high switching cost as we can see from D&B’s 99.8% retention rate across the Strategic customer segment so customer wins will take time across this customer segment. There is likely a more immediate oppy within the SMB enterprise space that will require more localized data / information. This was a driver for the acquisition of Bisnode. Overall, there are certainly opportunities within the SMB space but it likely comes with more churn / shorter life-time value and the international opportunity is one that comes with higher execution risk given the nature of the different markets. Overall, moving the needle by 1%, as you can see below, requires a likely heavy lift in the Strategic market, a modest lift in the Field Sales market, and a lighter lift in the Inside Sales markets. While the company believes this is a 1-2% contributor to organic growth over time, a betting man would underwrite 0-1% at this time.

Fig. 7) D&B Customer growth sensitivity (FY 2020)

Source: Company data

Fig. 8) D&B client base by market classification

Source: Company data

6) New products / solutions: +0-1%. Mgmt views cross-sell / upsell and new products / solutions as two separate organic growth levers but they are fairly similar in nature. Part of the reason is that the company has introduced a dizzying amount of new products / solutions over the past 2 years, which in totality surpass the new product generation of the prior 5 years, but most of the products have been tested on and successfully adopted by the current customer base, the natural first adopter. Separately, the companyappears to have fairly successfully monetized some newer subscription products across the SMB space that are expected to lead to organic growth generation in 2H21 as they lap the year mark. This products are all tied to D&B Connect, D&B Marketplace, and D&B Rev.Up. Time will tell as we are effectively taking mgmt’s word for it at the moment. Overall, this is the most difficult organic growth generation lever to handicap / underwrite over the long term and therefore a conservative underwriter would ascribe a 0% weight to this lever and let the surprise be a positive one vs a negative one.

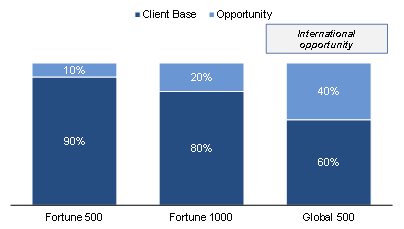

- Also, accelerated capital allocation to strategic growth acquisitions; Bisnode was a major win with Bisnode. Mgmt has materially increased capital allocation to growth investments since taking over in 2019. Organic growth, as previously discussed, is critical to achieving this acceleration in organic growth but it has been and is expected to continue to be supplemented by strategic acquisitions. In addition, Bill Foley on Cannae’s 4Q20 investor call indicated that he expects the company to remain acquisitive in the future and in 2021. Overall, earlier examples of M&A by D&B under the new group were more focused on acquiring specific tools and applications with the acquisition of Bisnode clearly signaling that the company is happy to play a consolidator in the space.

- Two of D&B’s four acquisitions since the new team took over have been in the Sales & Marketing vertical, which is among the highest growth end-markets across all information / business services segments (e.g. Zoominfo’s organic growth), which strategically makes sense given the opportunity at hand. However, mgmt is also not straying from the core franchise that has exceptionally high switching costs with the acquisitions of CoAction.com and Bisnode.

o Bisnode is the largest transaction in the company’s history by multiples and effectively 2x’d D&B’s direct revenue exposure to the attractively growing European markets in the Scandinavia and Germany, Austria and Switzerland (weird to say that). Bisnode is definitely much smaller than Bureau van Dijk, the 800lb pound gorilla in Europe, but this new client list, which includes another 50 in the Global 500, will push D&B’s total exposure to 350 or 70% of the Global 500. Channel checks have suggested that there is also untapped pricing power here as well. Bisnode was also acquired on the cheap at a synergized EV / LTM EBITDA multiple of 7.0-8.0x (no revenue synergies) and is immediately accretive. One final thing here is that in the merger closing announcement Bisnode’s Belgian assets were quietly excluded from the acquisition which, paired with Foley’s comments on Cannae’s 4Q20 call indicating that he expects D&B to be acquisitive in 2021, may indicate that the company may move to acquire another Worldwide Network Alliance company. Altares is basically the only platform that fits the bill here. It’s likely that this asset won’t be as cheap, however.

- From a higher level, each of these transactions has strong strategic merit given the sensible attacking of highest growth, highest cross-sell, highest international, and highest potential for untapped pricing. See below for the full list of D&B acquisitions over the past 10 years:

o (Sales and Marketing) Acquired Lattice Engines in July 2019, which is a software company that supplies applications to analyze combine buying signals and apply advanced machine learning to help drive predictable marketing and sales performance

o (Sales and Marketing) Acquired Orb Intelligence in January 2020, which is also a software company that specializes in combining algorithmic web information extraction with human editing to support the database of company information with a focus on SMBs

o (Finance and Risk) Acquired CoAction.com in March 2020, which is leading provider of business collaboration software that automates and optimizes critical business functions and processes

o (Finance and Risk) Acquired Bisnode in January 2021, which is a leading European data and analytics firm and long-standing member of the Dun & Bradstreet Worldwide Network to expand D&B’s presence globally

Fig. 9) D&B Acquisition History

Source: Company data

Fairly Attractive Operational Inflection Point and Compelling Valuation.

- Operational inflection. Dun & Bradstreet possesses a fairly attractive operational inflection point over the coming 1.0-1.5 years with A) organic growth acceleration, as discussed above, B) balance sheet deleveraging and C) increase in free cash flow conversion. The organic growth acceleration, which will also support margins, is expected to play out in 2H21 and 2022 and will drive free cash flow growth to 5+%. Dun & Bradstreet also currently possesses a 4.6x net debt / EBITDA ratio and is expected to reach >4.0x net debt / EBITDA by the end of the year. The only potential prevention to the achievement of this is that mgmt has indicated that the company will continue to be acquisitive. With respect to free cash flow conversion, the company is likely to replace high-cost debt (10.25% and 6.875% coupon) with low-cost debt (4.00-6.00% coupon). These, all together, paint an attractive picture of operational turnaround with the latter two B) and C) possessing fairly low execution risk.

- Compelling Valuation. At this point, the risk/reward appears attractively asymmetric with the downside return IRR of 5-7% (+18% total return) over the next 3 years and the upside return IRR of >25% (+65% total return) over the next three years (downside = return generated from annual EBITDA growth of +5-7% and no multiple expansion; upside = return generated from annual EBITDA growth of >+8% and an exit multiple of 20.0x, which is below the IPO multiple of 21.0x). When evaluating probabilistic outcomes a downside revenue growth scenario below 0% with the positive momentum that the company has already generated on a core basis appears to be fairly low (e.g. 2020 revenues were flat). And if mgmt delivers on just consistently generating 3-4% organic growth, and the core organic growth figure was >3% in 1Q21 ex-various one-time items, it stands to reason the business should continue to grow revenues, margins and earnings and the multiple should expand to at least 18.0x in light of a regression-implied multiple based on organic growth and EV / NTM EBITDA and a DCF-implied exit multiple analysis and deliver a 45% return over 3 years. A DCF analysis, to lend credence to this valuation methodology, also sets a floor for valuation of $22.50/share with the following assumptions: 10% cost of equity (far above CAPM-derived cost of equity of 7% which is derived by +2.0% risk-free rate + 0.9 beta x 5.5% equity-risk premium), 4.5% FCF growth rate, 3% perpetuity growth rate. This value, importantly, assumes that revenue growth will be +2-3%. Ultimately, with the current valuation of the company 30% below that of the IPO valuation, which was and is in-line with peers, the bear-base return is conceptually generated from a flat multiple and modest EBITDA growth of 4-5% and the bull-case is conceptually generated from an expanded multiple to 18.0-20.0x and EBITDA growth of 5-7%. (Note: A DCF is not included below, but see Fig. 10 below for EV / NTM EBITDA over time. Also, see Fig. 11 and 12 for the progression of Wall Street EPS Estimates.)

Fig. 10) D&B TEV / NTM EBITDA

Source: Factset

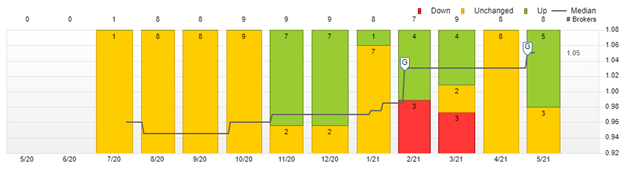

Fig. 11) D&B Progression of Wall Street EPS Estimates for 2021E

Source: Factset

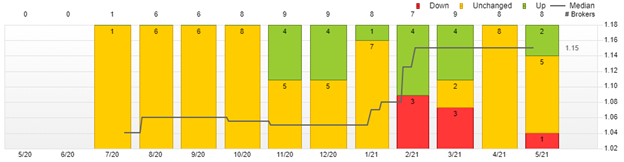

Fig. 12) D&B Progression of Wall Street EPS Estimates for 2022E

Source: Factset

Fig. 13) D&B and Peers Implied Valuation vs Organic Growth

Source: Company data

Fig. 14) D&B and Peers Implied Valuation vs Organic Growth

Source: Company data

Risks

- 24 months is not enough time to understand the business and recognize the long-term issues and therefore have overpromised

- Mgmt is not the team to do this given the CEOs dual roles

- Do another deal before “clean” organic growth story plays out

- Competition will be fiercer to respond to D&B’s go-to-market strategy changes and limit growth

- The business is still >4.0 net debt / EBITDA

- US gov’t is moving GSA from D&B. Is there another shoe to drop?

- 15.0x EV / NTM EBITDA is not the bottom or floor on valuation

- Accounting from the take-private may muddy the water